Accounting Services

Accounting forms the backbone of a company as its performance is determined by what is disclosed in financial documents. Companies incorporated in Singapore have to necessarily comply with the regulations prescribed by ACRA (Accounting and Corporate Regulatory Authority) Singapore and IRAS (Inland Revenue Authority Singapore). These are the two agencies to which companies must submit their financial documents and other records. Breaching or any violation of these rules will land the companies in trouble warranting legal action. Therefore, it is prudent to avail professional accounting services to meet the requirements.

JVKM Consulting has been offering the best package of accounting services to SMEs and MNCs for a very long time. We take care of bookkeeping, auditing and other management accounting requirements in compliance with the rules and regulations laid by – IRAS and ACRA. We cater to all industries – small and medium enterprises to big, national and international corporations. On top of providing up-to-date services, we use advanced software to maintain accounts

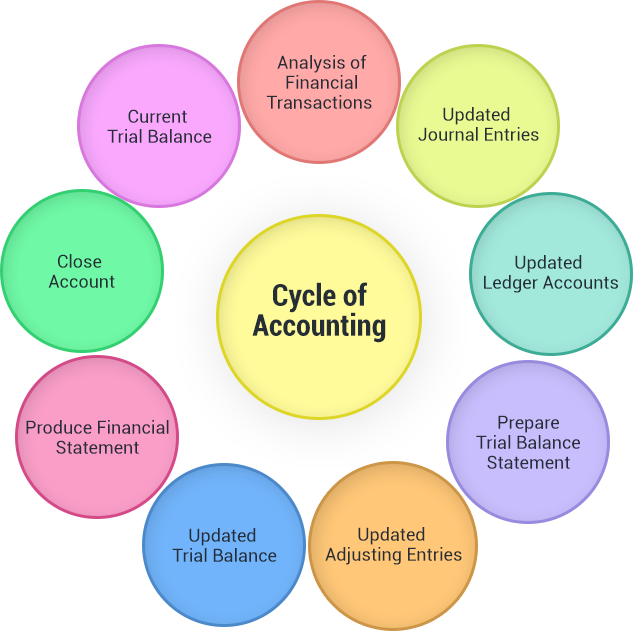

Pictorial depiction of the Cycle of Accounting

Our Services

As a leading accounting service provider in Singapore, we maintain the following financial statements:

- Bookkeeping

- Profit and loss accounts

- Balance sheet

- Bank reconciliations

- Comparison with last month’s/year’s accounts with ample explanation

- Trade debtors listing

- Trade creditors listing

- Maintaining general ledger

- Journal listing

- Preparation of a detailed schedule for various balance sheets and profit and loss items

- Payroll services

- Management Reporting

- Cash-flow reports on a weekly, monthly, quarterly and annual basis

- Preparation of payment vouchers

- Tax Filing and Planning

How JVKM goes about accounting?

JVKM will designate an account manager who will work closely with your company. S/he will be responsible for collecting necessary information from you and maintain ledger accounts and other financial documents on a periodical basis. The reports generated will be in compliance with the Financial Reporting Standards (FRS) and such reports will be submitted for statutory compliance.

BPO for Accounting Services

JVKM Consulting runs as an efficient BPO to cater to your business and accounting needs. It is prudent and practical to outsource accounting services to a professional team that has all resources, manpower and advanced technologies. Besides, companies will have sufficient time to focus only on value creation.

JVKM is reckoned as a strategic Accounting BPO firm to be partnered with. We work towards maximizing your goals and realizing business values through process-driven methodologies and best practices. We use software to maintain all your accounts and digitize your financial documents for easy access, retrieval, reference and standardization.

Our dedicated accounting professionals in our resource pool ensure that financial records are up to date and accurate. We take it upon our shoulders to take care of book-keeping, payroll, periodic management accounts for tax, business appraisal and planning purposes. We also provide you constructive advice on a regular basis and provide you with information that will help you to move beyond your immediate business goals.

Our services include:

- Compiling report for annual return to ACRA

- Preparing Director’s Report

- Maintaining the following documents

- Balance Sheet

- Trial Balance

- Bank Reconciliation

- Fixed Asset Schedule.

Benefits of Outsourcing

- It saves time and companies can focus more on core operations

- It saves you money as you don’t need to have an exclusive accounting department set up in your office. Further, you don’t have to pay salary, Central Provident Fund, bonuses and other benefits entitled to permanent employees in case of setting up a separate accounting department.

Singapore XBRL Filing Requirements with ACRA

Option A- Full XBRL Filing:

The full set of XBRL financial reporting comprises of the following.

- Balance sheet

- Reports of Auditors

- Income statement

- Statement of cash flow

- Director’s statements

- Statement of Changes in Equity

- All Notes to the Financial Statements

- Information denoted by a red asterisk in FS Manager.

Why Outsource XBRL filing services to JVKM Consulting?

JVKM Consulting provides professional assistance in filing statements in the XBRL format. It offers advisory services as well as takes care of accounting from start to finish by examining financial statements closely for accuracy. In addition, companies and their directors can dedicate their time and effort to attend to other tasks while JVKM looks into filing XBRL statements. Our efficient team brings to you all updates in ACRA regulations and taxonomy of XBRL filing.

Compiling Unaudited Financial Statements

Some companies are exempt from audit in Singapore on meeting criteria such as having no corporate shareholder or having less than 20 shareholders in the company or, not having revenue above S$5 million during a financial year starting from June 1, 2014. Likewise, banks and companies that credit and lend money to others are exempt from auditing. However, the exempt category companies have to prepare unaudited financial reports and submit the same by filling Form C after presenting them in the company’s annual general meeting.

Compilation of unaudited financial reports is done for the exempt companies to facilitate them to present the reports to creditors or banks. Besides, these reports are also submitted to local authorities of Singapore for compliance.

The unaudited records include profit and loss statements, balance sheet and financial statements. These documents disclose the financial performance of the company in the market and its own standalone performance. Compilation of unaudited accounts has been prescribed by ACRA and SFRS and is specifically in compliance with Singapore Companies Act Chapter 50.

All companies – a private enterprise, a public firm or a nonprofit organization – should prepare and present financial reports in their annual general meetings. JVKM helps in compiling these reports and in conducting periodical review of reports to help firms make wise decisions on future initiatives they plan to pursue.The report prepared should indicate the company’s performance and its future goals. Creditors such as banks and investors will study a company’s performance and financial statements before planning to invest in them.

JVKM Consulting also offers compilation of financial statement services for the exempted private companies in Singapore. We have professionals, Chartered Accountants to prepare and compile unaudited financial reports in time and in compliance with the Singapore Company Act. We take inputs from the company, its relevant documents before creating and compile reports for third parties.

Forensic Accounting

Forensic accounting involves fraud investigations of varied types. JVKM has highly experienced financial professionals who conduct investigations into financial irregularities and damages caused to business thereof. Every business is prone to risk and financial frauds across the globe.

Our professional accountants identify frauds or money laundering, conduct detailed investigations into them, and suggest measures to prevent their. recurrence. They also participate in legal disputes as expert witnesses and produce evidence and testimonials in a court of law.

JVKM Consulting offers the following services:

- Identify misconduct, fraud, money laundering

- Plan and conduct investigations into fraud

- Assess damages caused to business by the fraud

- Suggest measures to prevent fraud

- Provide expert witness in a court of law

Director’s Report Singapore

According to the guidelines of Singapore Financial Reporting Standard for Small Entities, a comprehensive document detailing the performance and health of a company’s business should be prepared by the director of the company. S/he as a director is responsible for preparing accurate, fair and flawless financial statements. In addition, the report connects organically the company, its internal stakeholders, its external stakeholders such as creditors, investors, government bodies, etc.

JVKM Consulting provides professional assistance in preparing Director’s report which constitutes a financial record of business and legal importance.

JVKM’s expertise in preparing Director’s Report?

There are several monitoring bodies – Accounting and Corporate Regulatory Authority Singapore (ACRA), Accounting Standards Council (ASC) and SFRS for Small Entities in Singapore – that stipulate that the financial statement be prepared in full compliance with the regulations of the Singapore government. This requires lot of meticulous effort on the part of companies. JVKM Consulting has professional accountants with abundant experience and knowledge to assist with the preparation of transparent and compliant director’s reports.

Our team provides the full gamut of following services in connection with preparing director’s report:

- Preparing financial statements, income statements and financial position statements

- Spelling out accounting policies, estimates

- Identifying errors and helping in preparing an error-free report

- Providing professional accounting, financial and legal advice

- Preparing a fair Director’s report that is compliant with the statutes of the Singapore government and that caters to the exact needs of stakeholders

Professional Accounting Services (REMOVE THIS ENTIRE PARA. IT IS REPEATED)

Accounting forms the backbone of a company’s requirement as a company’s performance is determined by what is disclosed in financial documents. Companies incorporated in Singapore have to necessarily comply with the regulations prescribe by ACRA (Accounting and Corporate Regulatory Authority) Singapore and IRAS (Inland Revenue Authority Singapore). These are the two agencies to which companies must submit their financial documents and other records. Breaching or any violation of these rules will land the companies in trouble warranting legal action. Therefore, it is ideal to avail professional accounting services to meet the requirements.

Corporate Accounting Services Singapore

Corporate Accounting is key to the sustenance of every business. Whether you are an existing or a start-up company wishing to set up your firm in Singapore, whether you are a small, medium or large business enterprise, whether your business is of sole proprietorship, partnerships or private limited companies, JVKM provides suitable professional accounting services.

JVKM has experienced professionals with rich industry knowledge, relevant expertise and a thorough understanding of the dynamics of businesses. You can count on our team’s competence and know-how to address your accounting requirements completely. We have been delivering commendable accounting services to leading corporate industries as well as small entities across Singapore.

JVKM ensures that your financial accounting, book-keeping services, tax and other accounting services are maintained up-to-date, in compliance with legal requirements of the government. We keep you updated with amendments made to Singapore laws to ensure that the accounting procedure is in compliance with the latest regulation in force.

How Professional Accounting Services would tick for you in Singapore?

Business owners of companies and their directors need to be concerned about tax and accounting compliance as much as they focus on the growth of their companies. Non-compliance leads to directors or owners ending up in jail. Not to let the focus get distracted on too many domains, JVKM presents itself as a company with track record of having provided professional accounting services to many firms in the past.

Our highly efficient team provides the following services:

- Preparing Income Statement, Balance Sheet, Cash Flow Statement

- Conducting periodical reviews – quarterly, half-yearly and annual

- Preparing Trial Balance

- Maintaining book-keeping records and other financial and accounting records

- Providing organic services on accounting in compliance with the statutory requirements of ACRS and ISRA

- Offering customized bespoken accounting services such as daily, weekly, monthly or on yearly basis depending on a company’s needs

- Using advanced accounting software to maintain records and process data for book-keeping, payroll and other services

- Maintaining Reconciliations of bank accounts and account transactions

- Preparing Director’s report

- Preparing Accounts payable & accounts receivable

JVKM Consulting helps you in identifying appropriate accounting needs, besides providing legal advice on company’s multiple financial and accounting affairs. Further, we also help you in saving the cost, time and effort of setting up a professional financial department with permanent employees. Our familiarity with the statutes helps in building your business and emerging as a successful and renowned entity in Singapore and on the global map.

A Company registered and incorporated in Singapore or a branch of a foreign company in Singapore can apply the SFRS for SE if

- They are not publicly accountable

- They publish general-purpose financial statements for external users

To know whether your company is a small entity, it must meet any two of the following criteria. If it fails, it is not possible to qualify for applying the SFRS for SE in your enterprise.

- Total annual revenue not to exceed S$10 million

- Total gross assets of the entity not more than S$10 million

- Total number of employees not to exceed 50